Most older adults want to grow old in the comfort of their own home, but many need extra help to make this happen. Home health agencies provide skilled care and services that help seniors to “age in place," but there are costs related to home health care.

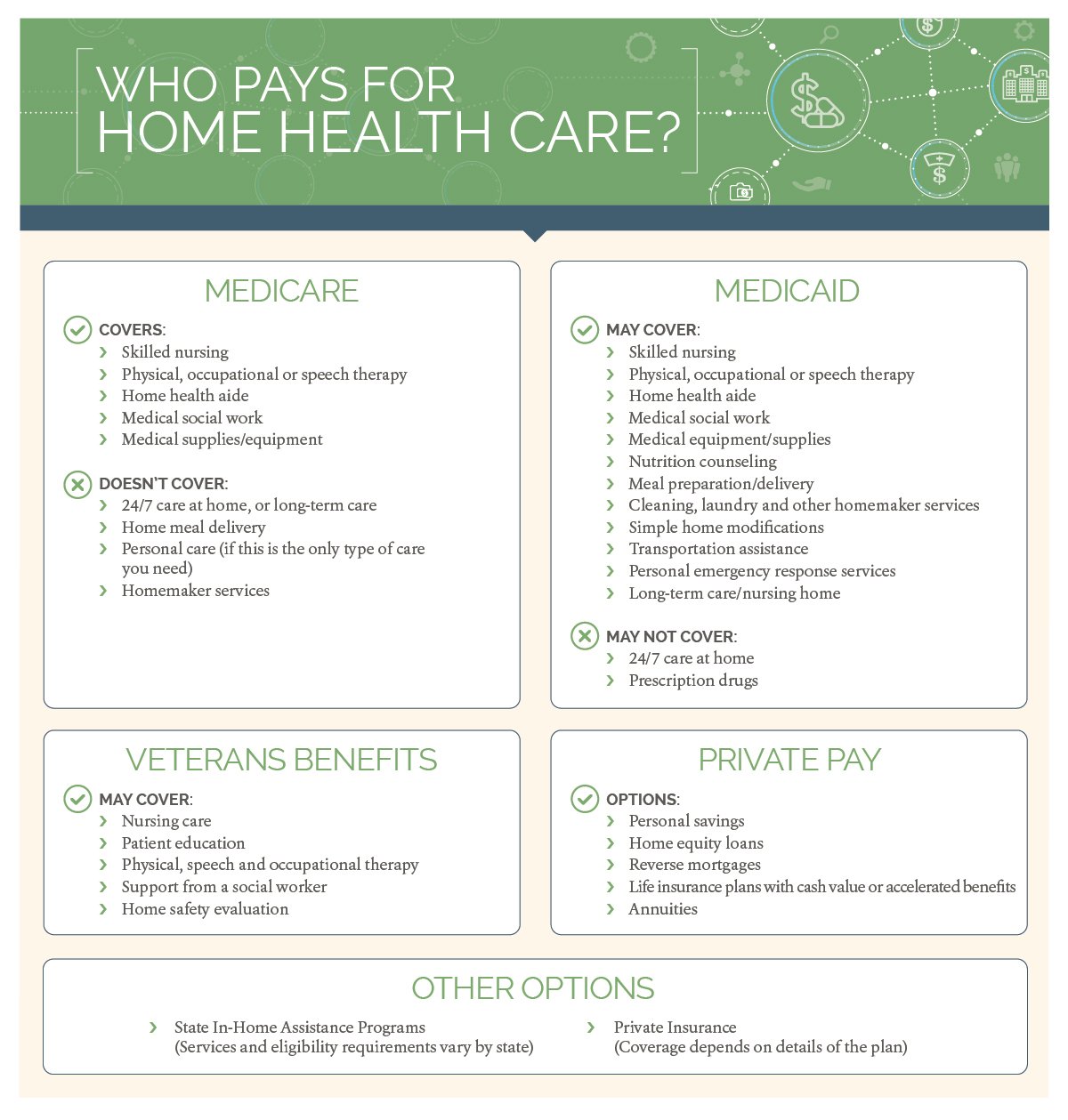

If you are wondering how to pay for home health care, there are several programs that help people pay for the cost. Here are the most common ways seniors pay for home health care:

- Medicare for Home Health Services

- Veterans Benefits

- Private Insurance

- Medicaid for Home Health Care

- State-Funded Programs

- Private Pay for Home Health

How to Pay for Home Health Care With Medicare

Medicare home health care coverage is a valuable benefit. Although it is the most widely used way to pay for home health care, it is still underutilized. Medicare typically covers 100% of skilled care services and medical supplies for eligible patients as long as certain conditions are met.

Medicare may be an option to cover home health services for you if: 1

- You have a doctor who regularly reviews your care plan.

- Your doctor certifies that you need skilled services that Medicare covers.

- The home health agency you choose is Medicare-certified.

- Your doctor says you’re homebound. Homebound means it’s hard for you to leave your home without help — like needing support from a person, walker, wheelchair, cane or other device. You might also be considered homebound if your health condition makes it unsafe to go out. Even if you leave home once in a while, you can still qualify if it takes a lot of effort and only happens for things like medical appointments or short, rare trips.

Medicare Coverage for Home Health Care

The Medicare home health benefit covers part-time or intermittent services, such as:

- Physical, occupational or speech therapy if necessary for treating your illness or injury.

- Skilled nursing, where a nurse comes to help you at home with things like giving injections, taking care of wounds, tube feedings, teaching you or a caregiver how to perform these tasks on your own, checking on changes in your condition and helping you follow your care plan.

- Help from a home health aide who can help with dressing, bathing and using the bathroom as prescribed in your care plan.

- Medical social services ordered by your doctor to address social and emotional concerns related to your condition. Examples include counseling and finding community resources.

- Medical supplies and equipment, including wound dressings, catheters and other medical supplies. Medicare Part B also pays for most of the cost of durable medical equipment, such as walkers or wheelchairs. 2

Home Health Services Medicare Does Not Cover

Some people think Medicare pays for all types home health services, but that’s not always true. To be clear, Medicare does not cover the following services:

- 24/7 care at home or long-term care

- Home meal delivery

- Help with getting dressed, bathing and using the bathroom (if this is the only type of care you need)

- Help with cleaning, cooking, laundry, running errands and other homemaker services

Medicare may not cover 100% of the cost of home health care if:

- Your doctor recommends services Medicare doesn’t cover.

- Your doctor recommends you get services more often than Medicare covers.

Before you begin care, Medicare-certified agencies are required to explain what Medicare will pay for. They must also let you know — both by talking to you and in writing — if there are any services or items that Medicare won’t cover, and how much you’ll need to pay. If something isn’t covered, they’ll give you a form called an Advance Beneficiary Notice (ABN) to let you know ahead of time. 3

Other Insurance Options for Home Health Care

There may be insurance coverage for home health care outside of Medicare coverage, depending on your situation. Consider the following and ask your home health agency for more information if you think one of these options may apply:

How to Pay for Home Health Care With Veterans Benefits

If you’re an eligible veteran, the Department of Veterans Affairs (VA) has programs that may help pay for home health care. Veterans benefits may cover:

- Nursing care

- Patient education

- Physical, speech and occupational therapy

- Services from a social worker

- Home safety evaluation

The cost of care varies, and there may be copays in some situations. Contact your VA social worker or case manager for information about the services available in your area.

How to Pay for Home Health Care With Private Insurance

Private health insurance plans may cover skilled, short-term, medically necessary home health care. However, if you need long-term care or non-medical home care, you’ll likely need a specific insurance policy. Coverage varies from plan to plan, and there may be copays in some situations.

Before making any decisions, review your insurance policy coverage and benefit materials for information about the services available under your specific plan.

How to Pay for Home Health Care With Medicaid

Medicaid may pay for home health care and non-medical personal care to help eligible individuals stay in their homes. Depending on your state, some people with disabilities, the elderly and families may be eligible for Medicaid. Check your eligibility and benefits, as Medicaid rules vary by state. If you’re eligible, Medicaid may cover:

- Skilled nursing

- Physical, occupational or speech therapy

- Home health aide to help with daily tasks

- Medical social work services

- Medical equipment and supplies

- Nutrition counseling

- Meal preparation and delivery

- Cleaning, laundry and other homemaker services

- Simple home modifications

- Transportation assistance

- Personal emergency response services

- Long-term care or nursing home residency

Depending on your state’s program, Medicaid may not cover prescription drugs or 24/7 care at home.

How to Pay for Home Health Care With State-Funded Programs

If you don’t qualify for Medicaid, you may be eligible for state in-home assistance programs. Most states have programs designed to keep seniors out of nursing homes and in their homes as long as possible. The services vary widely from state to state, as do eligibility requirements. Some cover caregiver support, whereas others provide money or help with meals, transportation and other services.

How to Pay for Home Health Care With Private Pay for Home Health

If you have resources available, private pay for home health may be an option. Some individuals use a combination of:

- Personal savings

- Home equity loans

- Reverse mortgages, which allow you to convert home equity into cash if you’re 62-plus 4

- Life insurance plans with cash value or accelerated benefits

- Annuities

Community organizations may also be able to direct you to meal delivery programs, financial grants for home modification and other services. Check with senior centers, religious organizations, nonprofits and your local Area Agency on Aging. These services may make it possible to live at home independently longer.

Find Care From Home With A Local Home Health Agency

All these programs and resources help people pay for home health care. Even if you’re struggling to make ends meet or have complex medical needs, you may be able to live safely and comfortably in your home.

Find out which benefits are available to you. Talk with your doctor or local home health agency about eligibility requirements.

Carolyn Hartsfield, MBA, RN, serves as Assistant Vice President of Nursing Strategy Innovation Programs at Amedisys. With 30 years of nursing experience, including 28 years in the home health industry, Carolyn brings a wealth of expertise to the field. She is passionate about improving home health services and dedicated to making a lasting impact in the industry.

References |